Purchase Agreement Focus: What Are Indemnification Baskets and Caps?

by Tom Venner

When Taureau Group negotiates a letter of intent or purchase agreement, whether on behalf of buyer or seller, one of the more important considerations are indemnification provisions related to the representations and warranties (“reps and warranties”). Reps and warranties are statements made in a purchase agreement that the parties rely on to be true and accurate, such as financial statements or customers/suppliers among many other disclosures. The indemnification provisions look to limit a seller’s potential post-closing liability and dictate the amount a buyer may recover in the event it incurs losses associated with an omitted or missed representation. Indemnification caps and baskets are critical to understand and negotiate as they are the financial parameters used to allocate risk between buyer and seller.

Indemnity Cap

The indemnification cap refers to the indemnification obligation of the seller to the buyer against breaches of reps and warranties. Certain reps and warranties are considered fundamental and are generally capped at or near the purchase price or even potentially beyond. Fundamental reps and warranties are core and necessary for a seller to insure and include, for example, having title and ability to sell the stock or assets of the company. Fundamental reps and warranties may have a survival period of a few years, the statute of limitations, or even indefinite survival, whereas non-fundamental reps and warranties generally have survival period up to 24 months.

The indemnity cap limits a seller’s maximum liability under the indemnification provisions to a stated dollar amount. When negotiating an indemnification cap, a seller will desire the lowest cap possible, while a buyer will seek a high cap or no cap at all. Per GF Data Spring 2019 Report, the average deal indemnification cap for non-fundamental reps and warranties as a percentage of enterprise value was 15.0% in 2018, an increase from 12.2% in 2017. This may signify that valuations have topped out and buyers have begun extracting more advantageous deal terms before seeking concessions on valuation.

As evidenced by the chart above, indemnification cap as a percentage of enterprise value is largely dependent on deal size, with smaller deals realizing relatively larger percentage caps.

Indemnity Basket

Indemnification basket refers to the amount that damages or losses must exceed before a seller is liable for any indemnification payments. An indemnity basket requires the buyer to incur a certain amount of loss before it can seek indemnification from the seller. There are typically two types of baskets: true deductibles and threshold/tipping baskets. With a true deductible, the seller is only responsible for losses exceeding the basket amount. With a threshold/tipping basket, the seller is responsible for all losses from dollar one, once the basket amount is reached.

As an example, assume the buyer and seller agree on a $100,000 basket and the buyer suffers $150,000 of losses. In a true deductible scenario, the buyer would be entitled to recover $50,000 in losses, while in a threshold/tipping basket scenario, the buyer would be entitled to recover the entire $150,000 of damages.

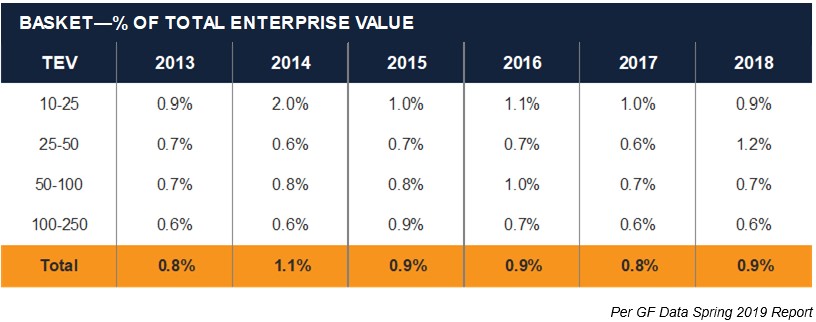

Per the M&A Market Trends Subcommittee, approximately 70% of deals are done with a true deductible, 26% are a threshold/tipping basket, and 4% include other terms. Per GF Data Spring 2019 Report, the average deal basket as a percentage of enterprise value was 0.9% in 2018 and has been largely unchanged over the last six years.

Survival Period

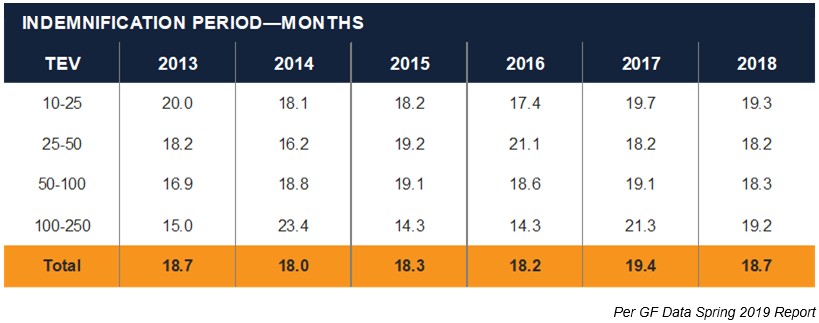

The survival period refers to the time after closing during which a buyer may assert a breach of the reps and warranties against the seller and collect any damages incurred. The average survival period across all deals was 18.7 months in 2018 for non-fundamental reps and warranties, in-line with the average length observed over the prior five years.

Reps and Warranties Insurance (RWI)

An increasingly popular option is to obtain reps and warranties insurance (“RWI”). Under an RWI policy, the buyer recovers directly from an insurer for losses arising from breaches of the seller’s representations and warranties in the purchase agreement. By shifting the risk of payment from seller to an insurer, the buyer and seller can both limit risk in the transaction.

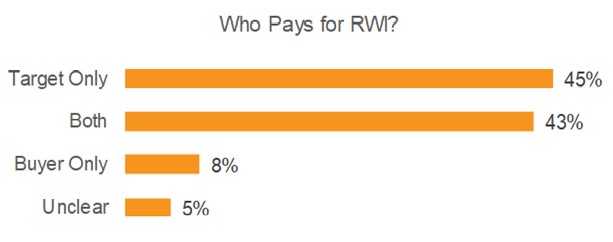

Per the M&A Market Subcommittee, approximately 29% of M&A transactions include RWI. Of those deals, the buyer acquired the policy 93% of the time. The party who pays the cost of the policy typically varies from deal to deal, as outlined below:

Conclusion

Negotiating the purchase agreement can be an extensive process and ensuring all deal terms are properly understood can take a great deal of diligence. However, those efforts are repaid by limiting post-transaction liability, work and headaches. Working with the right team of advisors to leverage their capacity and experience can alleviate some of this burden for the potential seller or buyer.

For more information or to explore any questions you might have regarding this article or mergers and acquisitions, please contact Tom Venner, analyst, at tv@taureaugroup.com or any member of the Taureau Group team at 414-465-5555.