Recap Introduction

by Michael Schroeder

RECAP INTRODUCTION

Learn the basics of how retaining equity following a sale could offer a lucrative and appealing investment consideration depending on your objectives.

If contemplating a sale (especially in today’s sellers’ market) and looking to stay involved (either through employment or ownership) to capture additional value from future growth of the business, a recapitalization or “recap” may be worth consideration. In the right situation, a recap can be a highly attractive investment for a seller when a second liquidity event in the future is realized. In summary, a recap is a structure that shifts a portion of business risk to an outside financial partner, typically a private equity group (PEG). Following an initial liquidity event or partial sale of the business (likely between 60 – 90%), an owner reinvests part of the cash proceeds in return for a continuing leveraged ownership stake in the business, generally a minority stake. This article will further introduce a recap and highlight some of the main concepts of which to be knowledgeable if presented with such an opportunity.

WHY CONSIDER…

In today’s M&A market, PEGs are increasingly seeking for seller’s to “roll over” a portion of their equity in a deal. This is attractive for the buyer as it can keep a seller engaged, reflects continued confidence in the business and is a source of capital when supporting the valuation (potentially a higher valuation). Ultimately, rolling over equity aligns the seller’s interests with those of the buyer post-transaction and is a form of seller financing or deferred purchase price.

A recap allows a seller to take some “chips off the table” while shifting business risk to an outside financial partner. With a new financial partner, potentially more experienced in growing businesses and having greater capital resources, a seller could benefit substantially from a second liquidity event in the future by realizing a “second bite of the apple.” While there is no guarantee that rolled equity will be a good investment, in the right situation, it can be very meaningful and valuable. The following is an illustrative example of how a recap could work.

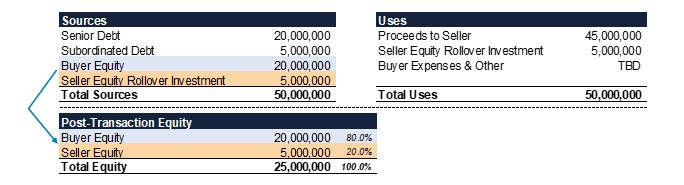

Original Sale for $50 Million and $5 Million Reinvestment

- Note that post-transaction equity for seller is generally determined on a dollar-for-dollar basis with the equity being contributed by the buyer (not on total enterprise value)

- Business are generally transacted on a debt-free, cash-free basis; all proceed figures shown are on a pre-tax basis and prior to any net debt obligations and fees being satisfied

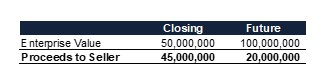

Subsequent Sale in Future for $100 Million

Assuming the business doubled in size and transacted again at a later date with no debt related to the business, the seller would have turned a $5 million investment into $20 million on the above example

ADDITIONAL CONSIDERATIONS

To reiterate, there are no guarantees regarding financial returns. That being said, a seller is often in the best position to judge future performance and outlook for the business. When considering a recap, a seller needs to contemplate how its financial partner will operate the business post-sale and what are its objectives. For example, is the financial partner aggressive or status quo, will there be add-on acquisition considerations, and who will run the day-to-day operations, among many other financial and non-financial considerations. Given the partnership nature of the transaction and proceeds being reinvested, a seller should take on some level of due diligence on the buyer, whether it be financial due diligence or seeking references from past deals.

Equally important is timing as there is no certainty of when a second liquidity event will occur. Most likely a minority investor post-transaction, a seller will not have ultimate control of when a second liquidity event occurs. Typically, PEGs look to hold investments for three to seven years, although there are varying instances that could dictate either a shorter- or longer-term hold. Usually, the seller’s rollover equity has the same rights as the other equity investors with neither party having the right to exit early or independently of the other. As a minority investor, a seller will also want to ensure they negotiate appropriate provisions such as mandatory tax distributions and no or limited requirements to make additional capital contributions, among other considerations.

In a recap transaction, the seller’s rolled portion may be fully taxable or 100% deferrable depending on how it is structured. If the rolled equity piece is meaningful, the seller will want to review with its advisors and ensure that the proposed transaction is structured in a way that permits the proceeds to be rolled on a tax-free basis. In addition, there are certain tax traps to be conscious of, such as “anti-churning.” Section 197 anti-churning rules come into play if the seller had interest in the business prior to August 10,1993 and is looking to own more than 20% of the equity post-transaction, and this is just one of many complex tax considerations when assessing a recap.

CONCLUSION

A recap structure can be an attractive option when contemplating a sale but should involve both financial and non-financial considerations and whether it fits the long-term objectives of a transaction. A seller must be honest with themselves if they are comfortable being in a minority position and having their business and reinvestment being led by a new partner. In considering a recap, a seller should also work with an experienced M&A team to clearly understand all the risks and, equally important, find the “right partner.”

For more information or to better understand your options related to transitioning your business, please contact Michael Schroeder, vice president, at ms@taureaugroup.com or any member of the Taureau Group team at 414-465-5555.