Risk Factors Affecting Business Value

by Tyler Carlson

Do you feel comfortable and confident with your answers to all of these questions:Is your leadership team aware of and focused on what protects and drives value and profit in your business?How does your company stack up to the factors that drive value?What factors pose a risk to the profitability and future value of your business?What’s the value of your business?

If so, no need to waste your time reading this article, otherwise let’s proceed.

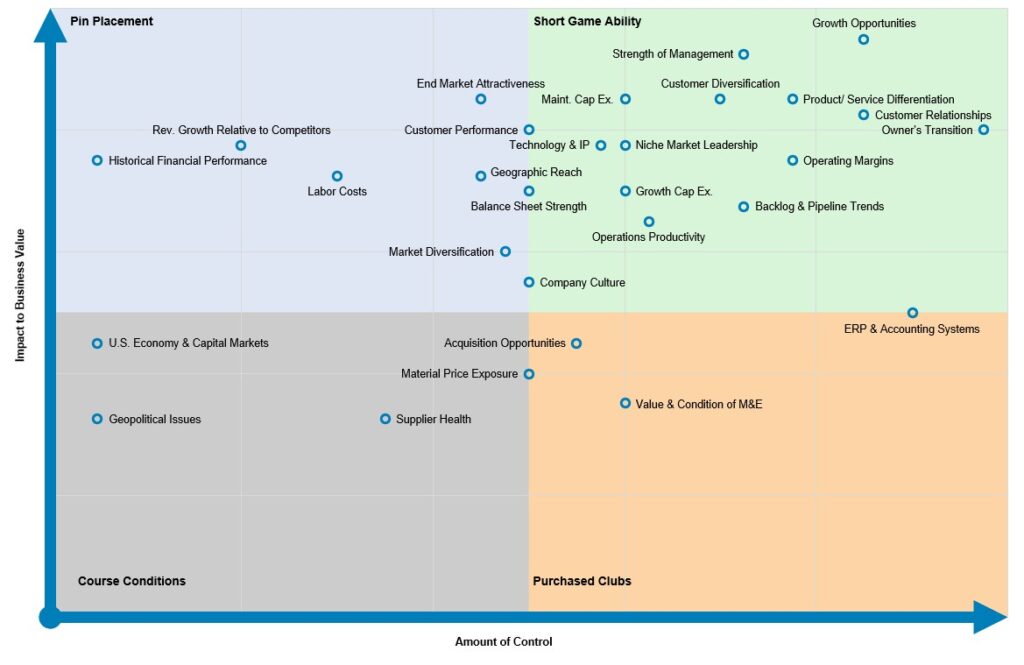

The chart above shows many of the most common drivers of business value and relates your ability as an owner to control (x-axis) vs. the impact on the value (y-axis) of your business. I love golf and almost went to Penn State to join their professional golf management school, so I enjoy distilling complex M&A concepts to relatable golf analogies. Therefore, the items positioned in the lower-left quadrant I refer to as “Course Conditions.” These are items that, as a business owner, you have very little control over and shouldn’t be the focus of your efforts. Just as in golf, you can’t control the course conditions. As the rules state, “play the ball as it lies.” That means when you stripe your ball down the fairway, but it settles in a divot or any other undesirable spot in the fairway, you suck it up and hit your next shot. As all golfers know, once the ball is hit, you don’t control where it ends ups, so why focus our attention here? Let’s not spend much time focusing on the U.S. economy, the capital markets or geopolitical issues, because realistically you have little control of these factors.

The upper right quadrant is what I refer to as the “Pin Placement” area. In this quadrant, there is meaningful value to your business with these items, but you won’t have full control over the outcome. For example, if you hit your shot right off the tee and now need to fly over a sand bunker to land close to a tight pin, the next shot is going to have a significant impact on your score for that hole, but you will again have little control over the final resting spot of the ball after you hit the shot. While it’s essential to set yourself up off the tee to have the best angle into the green, sometimes there is only so much you can do. For example, the labor market is tight everywhere, so you have less control over these costs than before, and while you want to maximize the return on your expenses, focusing on lowering labor costs while keeping people engaged and motived is a difficult task. Likewise, picking end-markets to serve is an element your company controls, but it’s relatively difficult and time-consuming to enter new markets or take share from the competition. Therefore, these items should be a factor in your long-term strategic planning, but not the complete focus to drive value in your business.

Now, on to the lower right quadrant, which I refer to as “Purchased Clubs.” In this area, you get to select your putter, wedges, driver, irons, and balls, so you have much of the control in this sector. However, as golfers, we all dream of buying the perfect clubs so we can be a scratch golfer, but sadly, the reality is no golfer becomes a professional by purchasing a new set. I agree there can be meaningful improvement and value to scoring by purchasing new equipment, but if you have a lousy swing, to begin with, new clubs are not going to make you swing like Tiger Woods. However, I think the most meaningful thing you can do in this sector is to have a robust ERP / accounting system that generates useful reports to run your business. For example, your solution should allow you to see gross profit margins by product, customer, state, and end-market, so you can optimize your time and focus on the areas that are going to produce the best return on your investment.

The final quadrant titled, “Short Game Ability”, is the area on which you need to focus to drive the most value for your business. Just like in golf, those who practice and hone their short games skills are the golfers that tend to perform the best and shoot the lowest scores. For you, as the owner, let’s talk about a few:

1. Growth opportunities: buyers are purchasing your business for the potential it holds, not for your historical performance. The past performance gives a buyer perspective on how the company “should” perform under certain conditions and the variability in earnings. Therefore, businesses that trade for the highest EBITDA multiples are typically those that have ample opportunities for growth. So start identifying what these opportunities look like and develop a plan to take action.

2. Strength of management team: many buyers fear the day that the owner leaves is the day the entire company collapses because all the relationships and tribal knowledge are going too. To offset this concern and risk, develop, train and let loose your management team to achieve without you. Your goal should be to completely replace your position before you go to sell, even if you’re still on the payroll. The fewer responsibilities you have, the better, in the eyes of potential buyers (this statement assumes you’re retiring;, there’s a different perspective if you plan to stay with the business post-close).

3. Customer concentration: in the lower middle-market, a business that transacts for less than $250 MM, the value is impacted by the level of customer concentration. If you think about low-risk, high-reward and apply this to customer concentration, you would infer that higher concentration means high risk. If a customer that’s 30% of your business goes away, that’s a massive risk to the bottom-line of the company. Therefore, when businesses have more than 15% of revenue with one customer and over 60% with your top-ten customers, that’s a customer concentration risk. Thus, businesses that fall in this category typically receive lower values than similar type companies with a more diversified customer base.

4. Transition: the period after the transaction closes is a critical time for the buyer and seller to embark on the future and maintain a strong base. Thus, an owner that is willing to 1) stay on for at least one-year post-close 2) take a seller-note (i.e., finance a small portion of the transaction) or 3) roll-over equity in the new company dramatically increases their chances of garnering a higher price for their business. The higher price comes in the form of lower perceived risk, from the buyer’s point-of-view, because they know you are going to be right there with them trying to help the company grow. Therefore, plan on staying with the company you sold for a stable transition or including some of your proceeds as part of the capital structure to minimize the buyer’s risk.

If you would like to talk more about how to protect and grow value Taureau Group is partnered with the Wisconsin Manufacturing Extension Partnership (“WMEP”) to access risk factors that affect business value and provide recommendations to minimize risk and grow value. WMEP’s PRA™ PLUS -Profit Risk Assessment defines the factors that drive profitability and valuation for your organization. It helps you identify and proactively manage risks relative to your company’s continued profitability and valuation.

Here’s a snapshot of results from data collected during WMEP’s Profit Risk Assessment (“PRA”):

1. It’s evident that most companies don’t have a clear vision and strategy that’s been communicated throughout the organization which drives decision making and success

2. 75% of the companies don’t or aren’t strategically utilizing a board of directors to enhance and drive business performance

3. 45% of the companies have significant dependencies on only a few customers for a large portion of their sales

4. 55% of the companies have considerable market concentration issues

5. 44% of the companies are not generating enough revenue from new products

George Bureau and I would welcome the opportunity to talk with you about your unique risk factors and how we can help you drive value in your company.