Archive: Manufacturing

M&A Quarterly Newsletter – March 2025

The latest happenings at Taureau Group and statistics from the M&A market

M&A Quarterly Newsletter – December 2024

The latest happenings at Taureau Group and statistics from the M&A market

M&A Quarterly Newsletter – September 2024

The latest happenings at Taureau Group and statistics from the M&A market

M&A Quarterly Newsletter – June 2024

The latest happenings at Taureau Group and statistics from the M&A market

M&A Quarterly Newsletter – March 2024

The latest happenings at Taureau Group and statistics from the M&A market

Deal Announcement

Subsidiaries of Taureau Group’s client, Material Handling Holdings, LLC, a portfolio company of Borgman Capital, LLC, have been acquired by Ballymore Company, Inc., a portfolio company of Graycliff Partners LP.

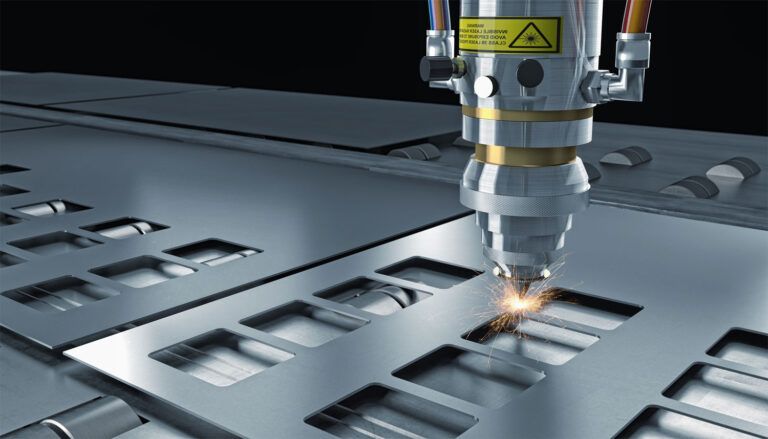

Industrial Manufacturing Still Attractive to Buyers in 2023

Industrial manufacturing deal volume declined in 2022 due to uncertainty from global economic and market influences. Rising cost of capital, inflation, geopolitical uncertainty, increased freight costs, and volatile raw material prices and availability is likely to continue to challenge M&A in 2023. As a result of these pressures, M&A activity for manufacturing companies has been…

Deal Announcement

Taureau Group’s client, The Jor-Mac Company, Inc. has been acquired by The Mendota Group.

Deal Announcement

Taureau Group’s client, The Kinetic Co., Inc., has been acquired by Precision Marshall, a subsidiary of Live Ventures Incorporated.

Deal Announcement

Sentry Equipment Corp. has acquired Universal Separators, Inc., dba SmartSkim.

Deal Announcement

R&B Grinding Co., Inc. has been acquired by an affiliate of Willis & Smith Capital.

Deal Announcement

Racine Metal-Fab, Ltd. has been acquired by Midwest Products and Engineering (MPE-INC).

Taureau Group’s Featured Team Member: Michael Erwin

This month’s Featured Team Member is our Senior Operating Partner, Michael Erwin.

Taureau Group Closes Another Transaction

Sanborn Tube Sales of Wisconsin, Inc. was acquired by Russel Metals, Inc. (TSX: RUS)

Buyer or Seller: Is It a Zero-Sum Game?

With the U.S. economy in its 10th consecutive year of growth, business owners continue to hear that M&A is a sellers’ market, which to most instinctively means it’s a good time to be a seller and a bad time to be a buyer.

Driving Value in Manufacturing

M&A market continues its strong trajectory in 2019 fueled by business growth objectives, available resources from raised private equity funds and growing corporate balance sheets, debt financing available from commercial and mezzanine lenders, and an overall positive economy.